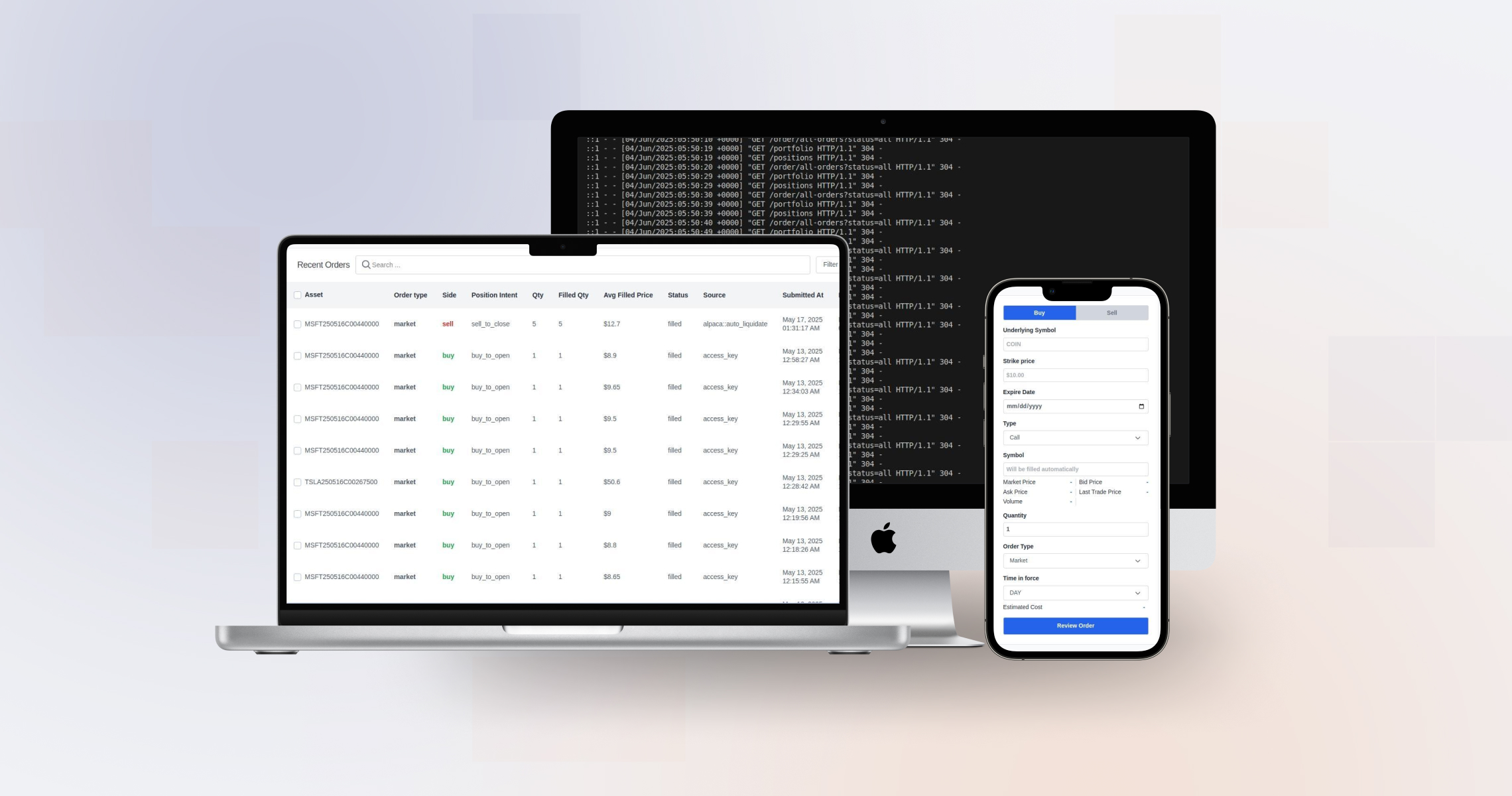

The 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐚𝐭𝐚 𝐂𝐨𝐥𝐥𝐞𝐜𝐭𝐨𝐫 & 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐁𝐨𝐭 is a sophisticated, high-performance trading platform built to optimize options trading. By integrating with the Alpaca API, this platform provides smooth access to real-time market data, facilitates quick trade execution, and offers comprehensive portfolio management for options traders.

It is built with a microservices architecture, ensuring scalability and high performance, designed specifically for traders who require precise data and quick execution, especially in fast-moving markets. s users to track trades, adjust

settings, and refine their strategies efficiently.

The platform’s frontend, crafted with React.js, provides an intuitive, responsive user interface, while the backend, powered by Node.js and JavaScript, coordinates trading operations and API interactions. RabbitMQ handles communication between microservices, ensuring smooth and efficient data transfer, while Axios is used for reliable and swift API communication. We prioritized low-latency performance and robust security to safeguard the user's trades and data.

Our Contribution

As a development team, we took on the responsibility of designing and building the entire trading system. We worked on creating a seamless user experience by providing real-time updates of market data and streamlining the options trading process.

The platform's ultimate goal was to create a smooth, secure, and highly efficient trading environment explicitly customized for options trading.

Languages and Technologies

To ensure a fast, secure, and scalable trading platform, we leveraged the following technologies:

Frontend Technologies:

Existing trading platforms were insufficient in meeting the needs of traders who require fast, automated, and customizable solutions, especially for options trading. These platforms could not often:

This lack of automation and delay in execution led to missed opportunities, inefficient risk management, and potentially higher losses.

We created a trading system that automates key trading actions, manages portfolios in real-time, and executes buy and sell orders without manual intervention. Key features include:

1. Microservices-Based Architecture

This stack enables us to create a platform that is fast, scalable, and reliable while ensuring that users have a smooth and secure trading experience.

We began by understanding the client’s needs, focusing on real-time market data, seamless trade execution, and risk management features like stop-loss and take-profit.

We designed a microservices architecture for scalability and modularity, ensuring that each component could function independently while interacting efficiently.

We developed the frontend with React.js and the backend with Node.js. The Alpaca API was integrated for real-time data, and RabbitMQ was used for smooth communication between microservices.

We tested the system under heavy trading conditions, ensuring fast and reliable order execution while optimizing performance for real-time updates and high-frequency trades.

After deployment, we set up continuous monitoring to ensure the platform’s reliability. Feedback from real-world usage led to ongoing improvements and fine-tuning.

The Market Data Collector & Trading Bot is a powerful, scalable trading platform built for the modern options trader. By automating key processes, such as trade execution and risk management, the platform enhances efficiency while reducing the need for manual monitoring. With real-time market updates and efficient integration with the Alpaca API, the platform offers a secure, fast, and reliable trading experience.

If you're looking for a professional, automated trading solution, let’s collaborate to bring your trading vision to life!

"Great company, outstanding work and communication skills."

Connecting Care, When Every Second Counts.

Creating a Revolutionary NFT Collection

Ready to create a more decentralized and connected future?

Our technical experts offer a free consultation to help you plan your idea, requirements, and tokenomics before beginning development.

Let's discuss your ideaMahbub Shuvo

CEO at Core Devs ltd