Imagine trying to buy a home, but instead of navigating the winding maze of brokers, banks, and paperwork, your entire transaction is smooth, transparent, and nearly instantaneous.

Sounds like a futuristic fantasy? Not anymore.

Because we’re now part of the world where blockchain technology is revolutionizing industries, with real estate standing at the forefront of this transformation.

In this blog, we’ll delve deep into blockchain in real estate, recreating the future, and explore the myriad ways in which these digital ledgers are reshaping property transactions, offering unprecedented security and efficiency. So let’s begin!

What is Blockchain Technology?

Blockchain technology is a decentralized digital ledger system that securely records transactions across multiple computers in such a way that any recorded data cannot be altered retroactively without altering all subsequent blocks.

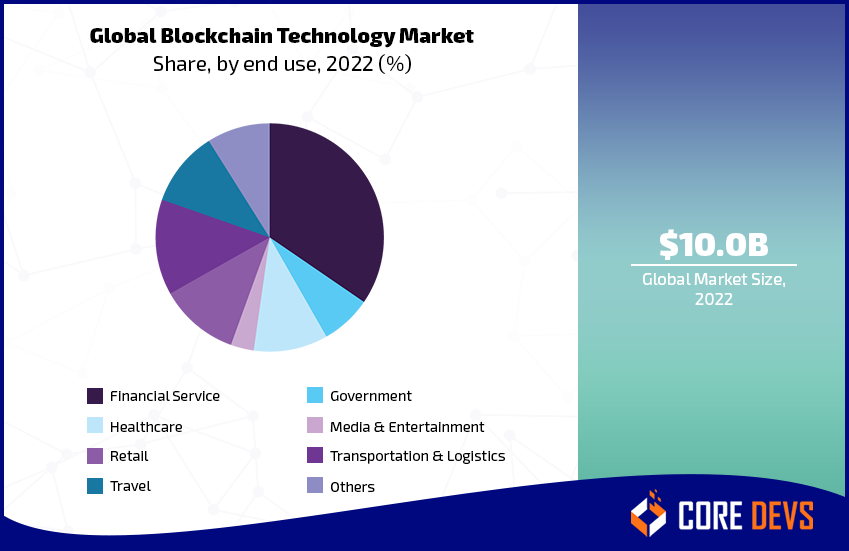

The use of blockchain technology is very diverse and is increasing day by day.

Let us have a look at the Global Blockchain Technology Market share by end-use, 2022(%).

Here’s a more detailed breakdown of Blockchain Technology.

Decentralized System

Unlike traditional databases, such as SQL databases managed by a central authority, blockchains operate on a network of computers known as nodes. Each node has a full copy of the blockchain, ensuring that no single point has control or can tamper with the entirety of the data.

Blocks

Blocks group transactions together. Every block has a set of transactions, a timestamp, and a cryptographic hash that links it to the prior block, forming a continuous chain of blocks.

Consensus Algorithms

Before a new block is added to the blockchain, a consensus must be reached among the network’s nodes. This consensus ensures that the newest block’s transactions are validated and that they haven’t been tampered with. Popular consensus methods include Proof of Work (PoW) and Proof of Stake (PoS).

Cryptographic Security

Once a block is added to the blockchain, it’s sealed with a cryptographic hash. This ensures the integrity and immutability of the data. If someone attempts to alter the information in a block, the hash will change, alerting the system to potential fraud.

Transparency and Immutability

Since every node in the network has a copy of the blockchain, it ensures transparent access to the data. Moreover, once data is recorded on a blockchain, it’s nearly impossible to change or delete, providing a trustworthy and unalterable history of all transactions.

Smart Contracts

Blockchain can also support programmable contracts known as “smart contracts“. These are self-executing contracts with the terms directly written into code. They automatically execute actions (like transferring funds) when predetermined conditions are met.

The Current State of Real Estate Transactions

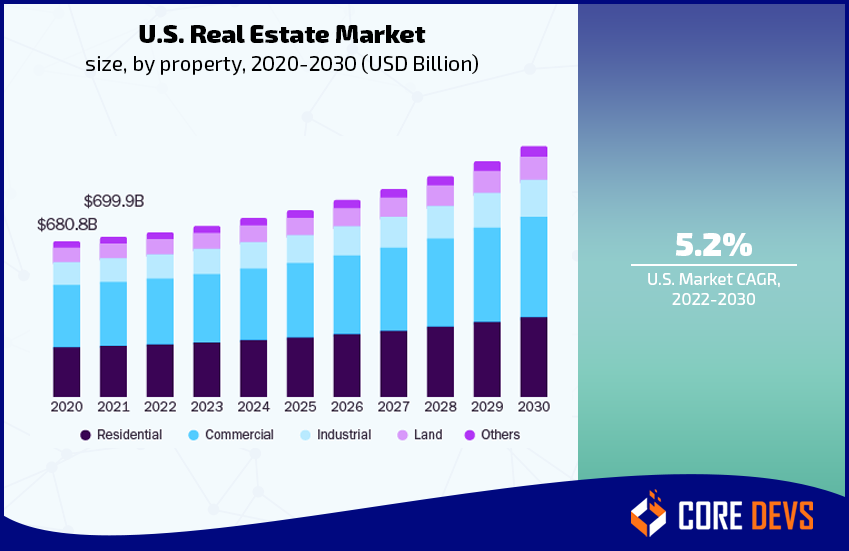

The real estate sector, for centuries, has been operating on foundational practices that, while proven, are riddled with inefficiencies. The U.S. Real Estate Market size, by property, is estimated to increase by 5.2% by 2030.

See the graph below.

A typical real estate transaction involves multiple stages, each introducing potential for delays and added costs.

Intermediaries Galore

One of the most defining characteristics of traditional real estate transactions is the involvement of various intermediaries. From real estate brokers who connect buyers and sellers to banks that finance the properties and title companies ensuring the legitimacy of property ownership – each plays a pivotal role.

While these intermediaries provide essential services, their involvement often complicates the process, making it longer and more cumbersome.

Existing Pain Points

There are 3 main existing pain points for real estate transactions.

- Delays: With so many parties involved, transactions can take weeks, if not months, to close. For instance, getting mortgage approvals from banks or verifying titles with title companies can take a while.

- Potential for Errors: The longer and more complex a process is, the greater the margin for error. Miscommunications can lead to incorrect property valuations, or missed details in title searches can create post-sale disputes.

- High Transaction Costs: Each intermediary in the process adds a layer of fees. Brokerage fees, bank fees, title insurance, and more add up, making real estate transactions notably expensive.

How Blockchain Addresses Real Estate Challenges?

The infusion of blockchain into real estate promises a paradigm shift in how property transactions are conducted. This novel technology offers solutions to several long-standing challenges in the sector.

1. Eliminating Intermediaries with Peer-to-Peer Transactions

At the heart of the blockchain is the ability to enable peer-to-peer transactions. This means that buyers and sellers can interact and transact directly without the need for brokers or other middlemen. Such a setup streamlines the process and significantly reduces associated costs.

2. Improving Transparency and Trust

One of the inherent features of the blockchain is its open ledger system. Every transaction, once recorded, is visible to all parties involved. This transparency ensures that all stakeholders can independently verify transactions, fostering an environment of trust.

Additionally, this eliminates the need for third-party verification, often a source of delays in traditional real estate transactions.

3. Immutable Record of Property History

A property’s history – including its previous owners, any structural changes, or disputes – can be recorded on the blockchain. This record, given the immutability of blockchain entries, remains tamper-proof.

Future buyers can easily trace back this history, ensuring they comprehensively understand the property’s past.

4. Transparent Transaction History

Beyond just property history, the financial transactions related to properties are also transparently recorded. Whether it’s the initial purchase, subsequent sales, or even rental agreements, every financial move is logged, ensuring both parties clearly understand the property’s monetary history.

5. Speed and Efficiency with Instant Verifications

Traditional real estate transactions often get bogged down during the verification process, be it verifying property titles or bank fund verifications. Blockchain, with its instantaneous verification capabilities, drastically reduces these waiting times.

Smart contracts can be programmed to automatically execute upon meeting predefined criteria, thus expediting the overall transaction.

6. Reduction in Fraud through Cryptographic Security

Blockchain transactions are secured with cryptographic signatures. Any tampering or fraudulent activity alters these signatures, making detection almost instantaneous.

This feature, combined with the transparent and immutable nature of blockchain records, greatly reduces the potential for fraud.

How Blockchain Technology is Changing Real Estate?

Thanks to blockchain, the age-old real estate sector, known for its complexities and significant capital requirements, is undergoing a technological renaissance.

From enhancing transparency to simplifying cumbersome processes, let’s explore how blockchain is reshaping the property market landscape.

1. Tokenization of Assets

The concept of asset tokenization is turning the traditional approach to real estate on its head. Rather than buying a property as a whole, blockchain enables properties to be divided into digital shares or tokens. Think of it like buying stock in a company.

This means that investing in real estate, traditionally a domain for the affluent due to its high entry barriers, becomes accessible to a broader audience. It not only democratizes property investment but also offers liquidity.

A token holder can trade their shares in secondary markets, introducing a level of flexibility previously unseen in real estate.

2. Smart Contracts in Real Estate

The real estate transaction process is often lengthy, involving numerous intermediaries – lawyers, brokers, notaries. Enter smart contracts: self-executing contracts with terms of the agreement directly written into lines of code.

Through blockchain, processes such as due diligence, payments, and transfer of property rights can be automated, significantly reducing the need for middlemen.

The result? Faster transactions, reduced costs, and less room for human-induced errors.

3. Property Search and Verification

One of the perennial issues plaguing the real estate sector is the authenticity of property details. With blockchain, every property can have a transparent and immutable record detailing its history, previous owners, and any incidents like natural calamities or disputes.

Potential buyers can independently verify this data, eliminating dependencies on agencies or brokers for genuine information. This builds trust and expedites the decision-making process for buyers and sellers.

4. Cross-border Transactions

International property deals have always been mired in bureaucracy, high fees, and prolonged waiting periods due to currency exchanges and regulatory procedures.

Blockchain offers a streamlined solution. With cryptocurrencies like Bitcoin or Ethereum, cross-border transactions can be settled within minutes, irrespective of the amount.

Moreover, as digital currencies are borderless by nature, they effortlessly bypass conventional banking systems, slashing transaction costs and time.

5. Challenges and Future Outlook

Despite its potential, blockchain’s integration into real estate isn’t without hurdles. Regulatory frameworks across countries are still in their infancy, causing uncertainty for both investors and developers.

The adoption rate is another challenge; while the tech-savvy might embrace it, the larger population needs to understand and trust this new model.

However, the future remains promising. As blockchain platforms evolve, we can expect enhanced security features, more user-friendly interfaces, and a greater amalgamation of real estate processes onto the blockchain.

Regulatory bodies acknowledging the technology’s potential may craft more blockchain-friendly laws, further propelling its adoption.

The Future of Blockchain in Real Estate

As blockchain continues making inroads into the real estate sector, it’s essential to consider its transformative potential for the future. Let’s take a glimpse into the anticipated trends and expansions on the horizon.

Predictions and Trends

Here are some predictions and trends for the future of blockchain in real estate.

Tokenization of Real Estate Assets

One emerging trend is the tokenization of properties. Property owners can divide their assets into tokens (digital shares) and sell or trade them on blockchain platforms.

This could democratize real estate investments, allowing people to invest in fractions of properties, making high-value property investments accessible to a wider population.

Decentralized Marketplaces

We may see a rise in decentralized property marketplaces where listings, negotiations, and transactions all occur on blockchain platforms, reducing the dependence on traditional real estate agencies.

Expansion into Rental Markets and REITs

Let us now look at how blockchain is expanding into Rental Markets and REITs

Rental Markets

Landlords and tenants can benefit from smart contracts that automatically enforce rental terms, from payment schedules to maintenance responsibilities, ensuring smoother rental relationships and reducing disputes.

Real Estate Investment Trusts (REITs)

Blockchain can add a layer of transparency to REITs, offering potential investors clear views into assets, transactions, and returns.

Moreover, tokenization can also reshape REITs, offering more fluidity in trading and investment.

The Versatile Reach of Blockchain Beyond Real Estate

While we often look at the wonders of blockchain in real estate, did you know it’s shaping other industries too? For instance, in healthcare, it’s ensuring tamper-proof medical records.

In finance, transactions become more transparent and secure. Supply chains? They’re benefiting from increased traceability.

So, as we navigate blockchain’s marvels in property, let’s remember its transformative role in various sectors worldwide.

Curious? You can explore further by reading this blog.

Final Thoughts

As we stand on the precipice of a technological revolution in the real estate sector, it’s evident that blockchain in real estate is not merely an adjunct but a driving force of change.

The promise of more transparent, secure, and efficient transactions heralds a future where property dealings are devoid of traditional hurdles.

This blog isn’t just a question about how blockchain technology is changing real estate; it’s a testament to the paradigm shift awaiting the property market.

As with all innovations, early adopters may reap the most benefits, so staying informed and embracing this digital evolution is the key to unlocking unprecedented real estate opportunities in the future.