Are you curious about how blockchain can transform the insurance industry?

Look no further! Here, we’ll explore the benefits of blockchain in insurance and discuss various use cases.

We’ll also identify the challenges of implementing blockchain and propose solutions to overcome them.

Learn about the revolutionary role of smart contracts in streamlining insurance processes. Ready to explore future trends and opportunities of blockchain in the insurance sector? Dive in!

Unleashing Blockchain’s Transformative Potential in the Insurance Sector

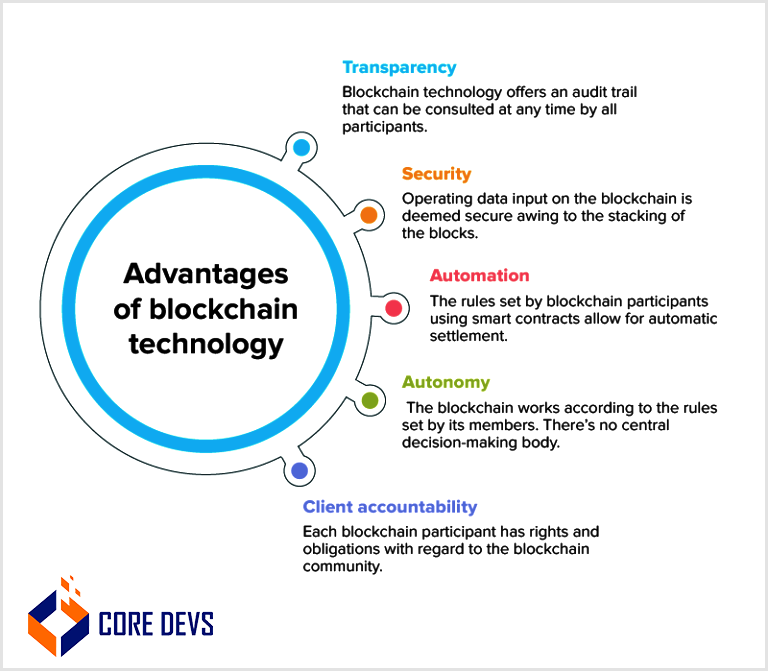

Incorporating blockchain technology can potentially revolutionize the insurance industry by offering many advantages beyond traditional practices.

This innovation promises a leap in efficiency, transparency, and customer experience while significantly curbing fraud and opening avenues for new practices.

Discovering blockchain’s impact on insurance unveils a host of benefits that redefine the landscape:

1. Counteracting Fraudulent Claims

Blockchain takes a decisive step in addressing a pervasive concern – insurance fraud. This is a critical issue, with annual damages worth a staggering $80 billion attributed to insurance fraud in the United States alone.

Employing smart analytics and strategies to counter fraudulent claims can only go so far. Blockchain’s inherent ability to record time-stamped transactions and comprehensive audit trails form a formidable defense against fraudsters.

The industry can thwart duplicate claims, counterfeits, and fabricated insurance demands by deploying blockchain-powered ledgers to authenticate valuable assets like jewelry.

2. Elevating Customer Experience

In a landscape where loyalty is no longer guaranteed, insurers must vie for customers’ trust without compromising their bottom line. Blockchain comes to the rescue through automated processing facilitated by smart contracts.

These contracts, integral to the blockchain, trigger payments upon fulfilling predefined conditions. This automation balances price competitiveness with dependable service, a critical factor in today’s market, where innovative models challenge traditional providers.

3. Fostering Trustworthiness

Blockchain’s innate architecture incorporating consensus algorithms paves the way for trust establishment among various stakeholders. The fusion of immutability and auditability creates an environment where smart contracts flourish.

These contracts, operating transparently and promptly, instill trust in transactions. Shared claims ledgers monitored by regulators offer real-time insights and significantly minimize fraudulent activities, making audits seamless.

4. Embracing Automation

Integrating smart contracts into the insurance process streamlines operations, rendering transactions transparent and efficient. This automation, executed seamlessly through blockchain, substantially benefits insurance companies.

Not only does it save time and effort, but it also slashes administrative costs, fostering operational efficiency.

5. Harnessing Data Potential

Data serves as the lifeblood of insurance companies. Blockchain, coupled with technologies like Artificial Intelligence (AI) and the Internet of Things (IoT), ushers in a new era of data utilization.

IoT-generated data finds a secure abode on the blockchain, subsequently interpreted by AI to inform informed decisions regarding insurance premiums.

This combination also extends to vehicle monitoring, providing insights into driver habits and vehicle performance that can be pivotal in designing tailored insurance offerings.

6. Strengthening Data Security

Data breaches and unauthorized access to sensitive information pose significant threats to the insurance sector. Here, blockchain’s cryptographic nature plays a pivotal role.

By design, each information stored on the blockchain is encrypted and linked to the preceding data, forming an unbreakable chain.

This security framework ensures that data remains tamper-proof and resistant to unauthorized alterations, creating a fortress of protection against cyber threats.

7. Streamlining Claims Processing

The intricacies of claims processing often involve multiple parties, leading to delays, disputes, and inefficiencies. Blockchain’s ability to create a shared, real-time, immutable ledger can revolutionize this aspect.

The process becomes transparent, ensuring all stakeholders are on the same page.

Claims verification, settlement, and communication become seamless, leading to quicker payouts and higher customer satisfaction.

8. Unlocking Parametric Insurance

Blockchain’s capability to gather and validate real-time data from various sources can pave the way for innovative products like parametric insurance. In this model, predefined conditions trigger automatic payouts.

For instance, in the case of weather-related risks, blockchain can monitor meteorological data and execute payments when specific conditions are met.

This automation accelerates claims and opens doors to new risk coverage models.

9. Enabling Peer-to-Peer (P2P) Insurance

Traditional insurance often involves intermediaries that drive up costs. Blockchain’s decentralized nature can facilitate peer-to-peer insurance models, where individuals directly connect to share risks and claims.

This eliminates intermediaries, reduces administrative overheads, and fosters a sense of community among insured individuals.

10. Revolutionizing Reinsurance

Blockchain’s transparency and traceability can significantly impact the reinsurance sector. Reinsurers can gain real-time insights into primary insurance contracts and claim histories through shared and tamper-proof records.

This level of visibility enhances risk assessment, expedites settlements, and transforms reinsurance operations.

Revolutionizing the Insurance Industry through Blockchain Innovation

The disruption caused by blockchain innovation in the insurance sector is a phenomenon that cannot be ignored. The numbers underscore its inevitability and potential, making it imperative for insurance entities to adapt and harness its capabilities for a prosperous future.

Blockchain’s Game-Changing Impact on the Insurance Landscape

The insurance industry is experiencing a seismic shift courtesy of the groundbreaking innovation brought about by blockchain technology.

This transformative wave is not just a passing trend; it’s a fundamental reshaping that promises substantial benefits.

Projected Growth and Numbers That Speak

Market analyses reveal an astounding trajectory for blockchain in insurance. A report from Markets and Markets underlines that the global blockchain for the insurance market is anticipated to soar to an impressive USD 1,393.8 million by 2025.

To put this in perspective, this figure marks a remarkable leap from a modest USD 64.50 million in 2018, all while maintaining an exceptional Compound Annual Growth Rate (CAGR) of 84.9%.

Empowering Positive Change

Blockchain’s prowess extends far beyond the realm of cryptocurrency. The insurance sector stands to reap a plethora of advantages through the adoption of this technology.

The compelling package includes cost reduction, elevated customer experiences, enhanced productivity, amplified transparency, and more.

A Glimpse into the Future

The journey has only just begun. Forecasts by Gartner indicate that the integration of blockchain for insurance will witness an exponential surge in the coming years.

By 2023, organizations are expected to embrace blockchain more extensively, setting the stage for a colossal infusion of new business value – a staggering $3.1 trillion by 2030.

Seizing the Opportune Moment

For those well-versed in blockchain development, the present juncture is nothing short of a gold rush. The untapped potential of blockchain beckons, urging developers to delve into its intricacies, comprehend its practical applications, and foster business growth.

Transforming Insurance Through Blockchain: Key Use Cases Unveiled

The marriage of blockchain technology and the insurance industry is reshaping age-old practices. By embracing these use cases, the industry is embarking on a journey characterized by heightened efficiency, security, and accessibility.

As blockchain’s potential unfolds, the insurance landscape is poised for a dynamic evolution that promises to redefine industry norms and enhance customer experiences.

1. Smart Contracts

The first transformative use case of blockchain in the insurance sector revolves around smart contracts. These self-executing contracts redefine how insurance agreements are structured, eliminating the need for intermediaries.

Smart contracts, built upon the blockchain’s foundation, automatically execute agreed-upon terms between policyholders and insurers. This innovation ensures transparency through publicly viewable, time-stamped transactions.

The risks of manipulation and contract errors are drastically reduced by eradicating human interference. This accelerates claims processing and fortifies consumer trust and confidence in the industry.

2. On-Demand Insurance

Another pioneering application is on-demand insurance, allowing policyholders to seamlessly activate or deactivate their coverage. Managing the extensive records associated with such flexibility can be intricate.

However, blockchain’s prowess simplifies ledger maintenance. By leveraging blockchain, on-demand insurance providers streamline record-keeping throughout the policy’s lifecycle.

From underwriting to claims management, the blockchain ensures efficiency and accuracy, benefiting providers and policyholders.

3. Combatting Fraud and Abuse

Blockchain’s potential as an anti-fraud tool is undeniable. Fraud wreaks havoc on the insurance industry, costing billions annually.

Blockchain’s immutable ledger architecture becomes a bulwark against fraudulent activities. Time-stamped and permanent transactions provide an audit trail that prevents data tampering.

By moving insurance claims onto the blockchain, insurers gain a powerful tool to reduce fraudulent activities. Shared blockchain ledgers enable insurer coordination, facilitating fraud detection through historical claims data.

4. Reinsurance

Reinsurance, vital for shielding insurance companies from catastrophic losses, can benefit immensely from blockchain’s capabilities. The existing reinsurance process, convoluted and time-consuming, can be streamlined through shared blockchain ledgers.

This real-time platform updates transactions related to premiums and losses simultaneously for insurers and reinsurers. The result is time, cost savings, and automated settlement and claims processing.

PwC’s estimation of potential savings of up to $10 billion underscores the transformative impact of blockchain in reinsurance.

5. Microinsurance

Blockchain’s role in microinsurance is revolutionary, particularly in addressing distribution costs and low-profit margins. Automation driven by predefined rules can transform claims handling and underwriting in microinsurance schemes.

By minimizing manual intervention, blockchain empowers the scalability of microinsurance, extending security against perils to a broader population.

6. Health Insurance

Blockchain’s significance in health insurance is exemplified by its ability to securely share medical data between insurers and healthcare providers. Traditional sharing methods are expensive and time-consuming.

Encrypted patient records stored on the blockchain enable instant, confidential access to vital medical information. The synchronized data drives substantial cost savings while maintaining confidentiality and auditability.

7. Auto Insurance

In the realm of auto insurance, blockchain elevates efficiency. After a car accident, blockchain ensures swift access to relevant information for both insurers and clients.

Immediate payouts for clients and streamlined repair processes for insurers become the norm, setting a new standard in insurance experiences.

8. Life Insurance

Blockchain’s transformative impact extends to life insurance, where the often complex and time-consuming death claim process can be streamlined.

Automating claims registration through blockchain expedites the procedure, promoting transparency and trust. Insurers and insured parties benefit from a more efficient and secure process.

9. Supply Chain Insurance

Beyond traditional domains, supply chain insurance emerges as a pivotal arena where blockchain’s impact shines. The global trade landscape, fraught with complexities, demands a robust solution for risk management.

Blockchain’s immutable ledger technology can provide a transparent and tamper-proof record of transactions, shipments, and goods’ conditions.

This ensures accurate risk assessment, efficient claims management, and fortified trade networks.

10. Enhanced Customer Engagement

Blockchain’s transformative potential extends to fostering deeper customer engagement. By securely storing customer data and preferences on the blockchain, insurers can tailor offerings precisely to individual needs.

Personalized insurance products, competitive premiums, and value-added services can be curated based on verified and immutable data. This enhances customer satisfaction and drives customer loyalty in a competitive market.

11. Seamless Regulatory Compliance

Navigating the labyrinth of regulatory compliance can be daunting for insurers. Blockchain’s inherent transparency and traceability can play a pivotal role in streamlining compliance efforts.

Regulatory documents, contracts, and audit trails can be securely stored on the blockchain, facilitating real-time monitoring and reporting.

This proactive approach reduces compliance-related risks and establishes a robust foundation for interactions with regulatory authorities.

12. An Ever-Evolving Landscape

The insurance industry faces challenges and opportunities as it strides forward with blockchain integration. The complexities of legacy systems, interoperability concerns, and scaling issues demand strategic solutions.

Collaboration between industry stakeholders, technology providers, and regulators becomes essential to unlock the full potential of blockchain in insurance.

Amid these challenges, the opportunities for enhancing operational efficiency, customer experiences, and trust-building are immense.

Real-Life Examples of Innovation

Blockchain technology has swiftly transformed various industries; the insurance sector is no exception.

Let’s look into the tangible applications of blockchain within insurance, spotlighting real-world instances where companies have harnessed its potential to bring about meaningful change.

1. Lemonade’s Customer-Centric Approach

Lemonade, a trailblazing player in the insurance realm, employs the synergy of blockchain and AI to provide cost-effective insurance solutions to homeowners and renters. By charging a fixed fee from monthly payments, Lemonade channels the remainder toward future claims.

The innovative aspect lies in the swift verification of claims through smart contracts embedded in the blockchain, enabling prompt customer compensation.

2. Ryskex’s Risk Management Innovation

Ryskex, an emerging blockchain-based insurance startup, has redefined risk assessment for insurers.

Its platform leverages blockchain to facilitate accurate risk evaluation and management, fostering a more streamlined and efficient insurance process.

3. ClaimShare’s Fraud Prevention

Addressing a persistent concern, ClaimShare introduces blockchain technology to tackle the issue of double-dipping – a fraudulent practice wherein a claimant deceitfully receives payouts from multiple insurers for a single incident.

By enabling insurers to securely share claims-related data, ClaimShare safeguards against such fraudulent activities.

4. B3i’s Collaborative Endeavor

Established in 2018, B3i has swiftly made its mark by offering advanced solutions that enhance consumer experiences in the insurance market.

This entails expediting insurance accessibility and curbing administrative expenses through blockchain integration.

Empowering Insurance Through Blockchain: Pioneering Applications

Blockchain’s potential in the insurance sector is rapidly reshaping traditional practices.

Let’s identify these transformative real-world examples showcasing how blockchain revolutionizes insurance operations.

1. Etherisc

Etherisc pioneers decentralized insurance protocols powered by blockchain. Their platform enables communities to create and manage their insurance products, thus democratizing the insurance landscape.

This innovative approach enhances transparency and trust, allowing participants to manage risks collectively.

2. AXA

Global insurance heavyweight AXA introduced a blockchain-based solution to expedite flight delay insurance claims.

By automating the claims process through smart contracts, AXA significantly reduces the time customers wait for their claims to be processed and paid out.

3. MetLife

MetLife Asia utilized blockchain to enhance health insurance claim processing.

Through tamper-proof records and automated verification, the claims settlement process becomes more accurate and efficient, minimizing errors and delays.

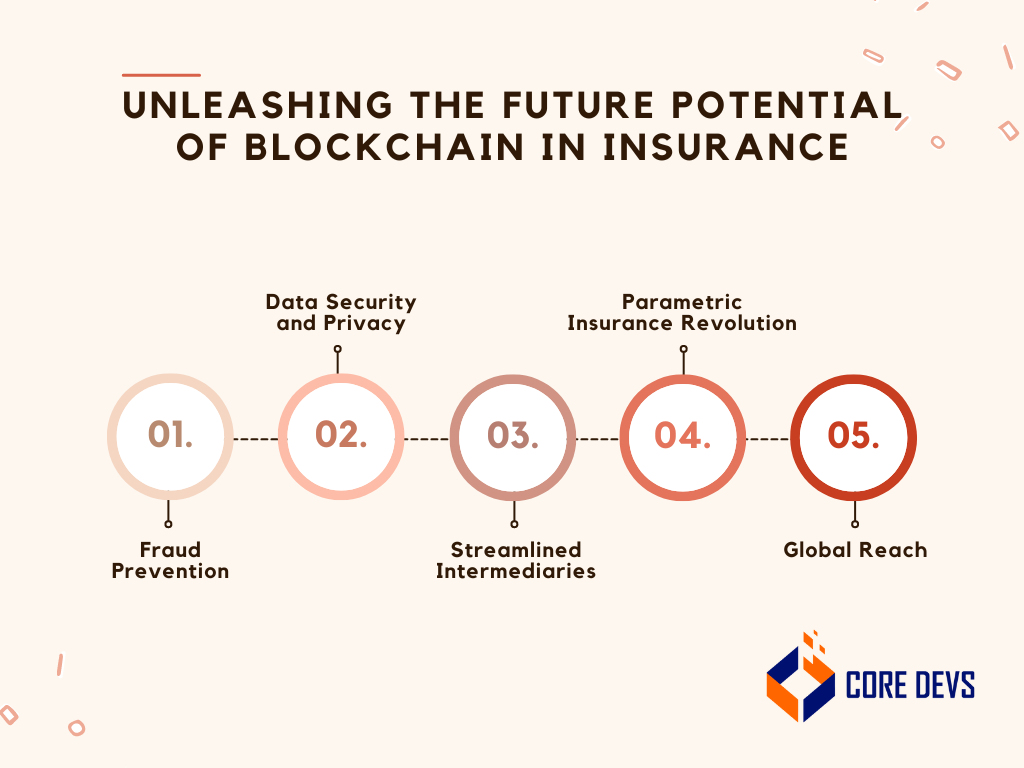

Future Potential of Blockchain in Insurance

Blockchain’s impact on insurance is an ongoing journey of innovation. As the technology evolves, its potential is poised to reshape insurance ecosystems further.

Key areas of exploration include:

Fraud Prevention

Blockchain’s immutability and transparency can create an impervious barrier against fraudulent activities, safeguarding insurers and policyholders.

Data Security and Privacy

Blockchain’s cryptographic security offers a robust shield for sensitive customer data, ensuring confidentiality and reducing the risk of breaches.

Streamlined Intermediaries

By eliminating intermediaries, blockchain can optimize administrative processes, minimizing paperwork and associated costs.

Parametric Insurance Revolution

Blockchain’s automated execution of contracts can pave the way for parametric insurance, where claims are triggered automatically based on predefined conditions.

Global Reach

Blockchain’s decentralized nature could simplify international transactions and policy issuance, eliminating complexities associated with varying regulations.

Exploring Challenges in Blockchain Adoption within the Insurance Sector

Integrating blockchain technology in insurance promises innovation, transparency, and efficiency. However, as with any transformative technology, there are several challenges that need to be addressed for seamless adoption.

Here, we determine the limitations of using blockchain within the insurance industry.

1. Complexity Hindrance

Understanding the intricacies of blockchain technology can prove to be a significant barrier. The complexities surrounding encryption and distributed ledgers can overwhelm users, impeding their ability to grasp the technology’s benefits.

To overcome this challenge, seeking the assistance of professional blockchain development services is advisable. Experts not only illuminate the vast advantages of this innovative technology but also guide businesses in adopting tailored solutions that align with their unique needs.

2. Nascent Stage Concerns

Blockchain’s development is still in its nascent stages, which brings forth a set of challenges. Issues such as data limits, transaction speed, and verification processes must be effectively managed to make blockchain widely applicable in the insurance domain.

Industry players must collaborate to address these limitations and drive the technology’s evolution.

3. Regulatory Uncertainty

The insurance sector operates within a framework of dynamic and frequently changing regulations. This uncertainty presents a stumbling block for blockchain adoption. The unsettled regulatory landscape hinders the extensive integration of blockchain by insurance carriers.

Collaborative efforts between technological innovators and regulatory bodies are essential to establish a conducive environment for blockchain growth.

4. Initial Costs vs. Long-Term Gains

While blockchain promises substantial reductions in transaction costs and processing times, the initial investment required can be a deterrent. Implementing blockchain involves significant upfront costs, including technology setup, integration, and training.

However, it’s crucial to recognize that these expenses are investments that yield long-term benefits. Companies must assess the potential return on investment and factor in the transformative impact on their operations.

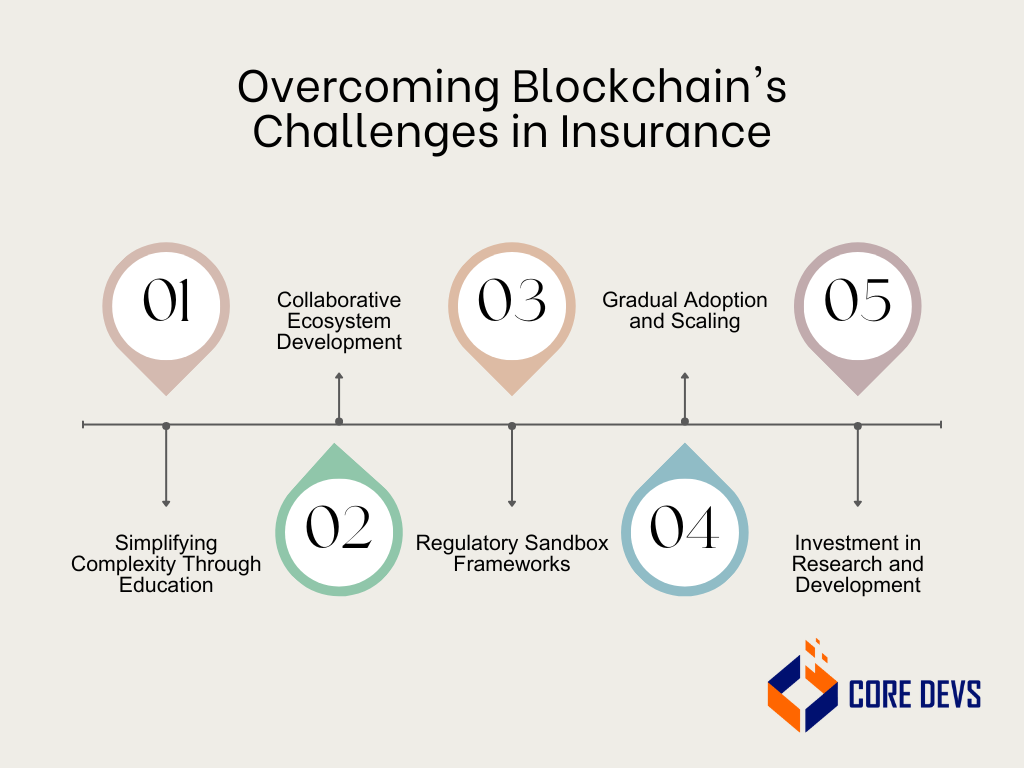

Overcoming Blockchain’s Challenges in Insurance – Pioneering Solutions for a Seamless Future

Despite the challenges, the insurance industry is determined to harness the transformative power of blockchain. Innovative strategies are emerging to tackle these obstacles head-on and ensure the widespread adoption of this revolutionary technology.

1. Simplifying Complexity Through Education

Recognizing the complexity hurdle, industry players are investing in educational initiatives. Workshops, seminars, and online courses are designed to demystify blockchain’s technical intricacies.

By equipping stakeholders with a comprehensive understanding of encryption, distributed ledgers, and smart contracts, the industry aims to empower them to leverage blockchain’s advantages effectively.

2. Collaborative Ecosystem Development

To address developing stage concerns, collaborative ecosystems are forming. Industry leaders, tech experts, and regulators are pooling their insights to identify and mitigate challenges related to data scalability, transaction speed, and verification processes.

Such collaboration accelerates the maturation of blockchain, making it a viable solution for insurance operations.

3. Regulatory Sandbox Frameworks

Governments and regulatory bodies recognize the need for adaptable frameworks for emerging technologies like blockchain. Regulatory sandboxes provide a controlled environment for testing and refining blockchain innovations.

This approach allows insurers to explore blockchain solutions under regulatory supervision, paving the way for smoother adoption on the broader industry.

4. Gradual Adoption and Scaling

Acknowledging the initial cost hurdle, companies are opting for gradual blockchain adoption. Instead of radical overhauls, businesses are integrating blockchain into specific processes or departments.

This step-by-step approach minimizes upfront expenses while capitalizing on blockchain’s benefits. As operational efficiencies become evident, broader integration becomes more feasible.

5. Investment in Research and Development

Technology innovators are channeling resources into research and development to address challenges in the insurance landscape. Focused efforts are being made to enhance data throughput, optimize consensus mechanisms, and bolster security protocols.

Such advancements will strengthen blockchain’s applicability in insurance and lay the foundation for further innovation.

Navigating Blockchain Challenges: Core Devs’s Innovative Solutions

Blockchain’s potential to revolutionize insurance operations is undeniable. This technology has the capacity to reshape asset tracking, management, and insurance in the digital realm.

At Core Devs, we stand ready to guide you through this transformative journey, addressing the complexities that come with it.

Comprehensive Solutions for a Decentralized Future

Our team of seasoned professionals is committed to facilitating your transition into the realm of decentralized solutions. We understand that blockchain adoption can be daunting, and that’s where we step in.

Core Devs offers various blockchain and crypto insurance development services, imbuing your business with scalability, transparency, and security.

Leading the Change in Global Insurance Dynamics

Across the globe, insurers are seeking ways to harness blockchain’s potential for transformative change. Core Devs is at the forefront of this movement, assisting insurers in recognizing how blockchain can reshape their operational landscape.

Our adept team of blockchain developers will guide you through the intricacies of distributed ledgers and encryption, ensuring that your organization crafts winning solutions.

Unlocking the Power of Blockchain: Your Partner in Progress

Whether you aspire to develop robust blockchain solutions for your insurance enterprise or simply seek to grasp the essence of blockchain insurance, Core Devs is your trusted partner.

We invite you to connect with us and embark on a journey of innovation, efficiency, and growth within blockchain-powered insurance.

Blockchain’s Expanding Impact Beyond the Insurance Realm

While we frequently discuss blockchain’s innovations in the insurance sector, have you ever pondered its implications in other industries?

Beyond streamlining insurance claims and policies, blockchain is reshaping sectors like healthcare, real estate, and finance.

With secure medical records, transparent property transactions, and more, its applications are truly wide-ranging.

Are you curious about how this single technology molds diverse sectors? Dive into our blog about blockchain’s use in various industries and discover blockchain’s influence beyond the insurance landscape.

Conclusion

Blockchain technology can potentially revolutionize the insurance industry by providing numerous benefits, such as improved efficiency, transparency, and cost savings.

With its ability to enhance data security and privacy through decentralized networks and smart contracts, blockchain in the insurance sector can address many of the challenges insurers face.

As this technology continues to evolve, more use cases and opportunities will emerge, offering exciting prospects for the future of blockchain in insurance.

So if you’re in the insurance sector, embracing blockchain could be a game-changer for your business.

Frequently Asked Questions

How Does Blockchain Improve Claims Management In The Insurance Sector?

Blockchain enhances claims management by creating a transparent and tamper-proof record of transactions, reducing disputes, and enabling efficient information sharing among stakeholders.

What Role Does Blockchain Play In Fraud Prevention For Insurance?

Blockchain helps prevent fraud in insurance by establishing a secure and immutable record of policyholders’ information and claims history, making it harder for fraudulent activities to go unnoticed.

Can You Explain How Smart Contracts Are Utilized In Insurance Policies Through Blockchain?

Smart contracts on the blockchain enable the automatic execution of insurance policies, ensuring that claims are paid out when predefined conditions are met, streamlining the process, and reducing administrative costs.

What Is Parametric Insurance, And How Does Blockchain Support It In The Insurance Sector?

Parametric insurance uses predefined parameters to determine payouts based on specific events. Blockchain enhances this by automating triggering event assessment and transparently executing payouts without requiring lengthy claims processing.