Have you ever wondered how much it costs to run a SaaS (Software as a Service) business? Imagine you’re a SaaS entrepreneur, excited about your innovative software, and ready to launch.

But soon, you start noticing a recurring expense – the Customer Acquisition Cost, or CAC.

In this blog, we’re diving deep into the Average CAC for SaaS. We’ll explore the challenges and solutions to calculate CAC and master this crucial factor for SaaS success.

Whether you’re a seasoned SaaS pro or just starting in the SAAS business, join us on this journey to unveil the secrets of Average CAC for SaaS and finally acquire a customer with confidence.

What Is the Expense for Acquiring SaaS Customers

Customer Acquisition Cost (CAC) is a vital metric in the B2B SaaS industry, representing the expenses incurred to acquire new customers. CAC varies based on industry and company size, even within niches.

For example, small B2B SaaS financial firms average a $1,450 CAC, while enterprises face $14,772. In SaaS healthcare, small B2Bs spend $921, compared to enterprises at $11,021.

Calculating CAC defines current spending levels, allowing you to set future benchmarks. You can strategize to reduce CAC over time or, in some cases, consider increasing it to boost overall revenue.

Monitoring key SAAS metrics like Lifetime Value (LTV), CAC ratio, and CAC payback is crucial.

Managing sales and marketing expenses, which comprise CAC, is vital for achieving a good CAC. Optimize marketing costs, improve conversion rates, and acquire more customers to succeed in the competitive B2B SaaS landscape.

Thinking about the challenges and triumphs of building your own SaaS product? Explore our blog on building SaaS from scratch, offering valuable insights to overcome hurdles and achieve success!

Calculating Customer Acquisition Cost

Learn the fundamentals of calculating Customer Acquisition Cost (CAC) with our concise guide.

The formula can be summarized simply as:

Marketing Overhead Expenditure per Customer Count

Suppose you invested $5,000 in marketing expenses during the first quarter of 2022, acquiring 50 customers. According to the formula mentioned earlier, your company’s Customer Acquisition Cost (CAC) for that quarter stands at $100.

For an accurate CAC calculation, it’s crucial to differentiate between various components of customer acquisition expenses. The marketing budget encompasses more than typical marketing expenditures like SEO and Google Ads.

It includes all costs that contribute to guiding customers through the sales funnel process, which may encompass:

1. SEO Marketing

In B2B SaaS, mastering SEO (Search Engine Optimization) is vital. It’s your guide to customer acquisition and a way to calculate and improve your CAC (Customer Acquisition Cost).

By optimizing your website for search engines, you can reduce the cost of sales, align with SAAS benchmarks, and enhance your B2B SaaS company’s visibility.

2. Cold-calling and Email Campaigns

In B2B SaaS, understanding your CAC benchmark is crucial. Cold-calling and email campaigns are part of your guide to customer acquisition, but to be efficient, you need to calculate your CAC by factoring in marketing and sales expenses.

Align with SAAS benchmarks to improve your CAC and consider total sales, marketing expenses, and the average customer lifetime for long-term success in driving sales.

3. Google Ads

In the world of B2B SaaS, understanding your CAC benchmark is vital. Google Ads, a potent pay-per-click platform, is a valuable tool in your guide to customer acquisition.

Consider your CAC to calculate marketing and sales expenses, including Google Ads costs. Align with SAAS benchmarks to improve your CAC, and don’t forget to assess the cost of sales.

Also, factor in total sales and marketing expenses and average customer lifetime for long-term success in your customer acquisition strategy, ensuring both customer success and a reasonable cost to acquire customers.

4. Outsourced Content Writers

Engaging outsourced content writers means enlisting skilled professionals to craft top-notch written material for your marketing arsenal.

These experts generate high-quality content for your website, blogs, marketing materials, and publications, ensuring that the content effectively captivates and educates your target audience, contributing to your brand’s overall success.

5. Social Media Marketing

Social media marketing harnesses the power of popular platforms such as Facebook, Instagram, Twitter, and LinkedIn. It’s designed to foster interaction with your target audience, construct brand recognition, and showcase products or services through organic and paid strategies.

By using these dynamic channels, businesses can establish meaningful connections, boost visibility, and drive engagement to achieve their marketing goals effectively.

6. Affiliates and Brand Ambassadors

Affiliates and brand ambassadors are valuable partners who actively endorse your products or services on their own platforms. Frequently compensated through commissions or benefits, they serve as influential advocates, substantially broadening your brand’s reach and enhancing its credibility.

These collaborations leverage the ambassadors’ existing audiences, lending authenticity and trust to your marketing efforts while fostering brand loyalty among their followers.

7. Promotional Giveaways

Promotional giveaways are a strategic marketing approach that offers customers complimentary products or services. This tactic fosters brand loyalty among existing customers, lures in new ones, and can serve as a dynamic tool for generating substantial brand buzz.

By providing value through giveaways, businesses can create positive associations, build goodwill, and establish memorable connections with their audience.

8. Technical Expenses, Such as CRM Software

Technical expenses encompass investments in essential tools like Customer Relationship Management (CRM) software. These systems are designed to efficiently oversee customer interactions, monitor sales leads, and optimize marketing efforts.

By harnessing data-driven insights, CRM software enhances customer acquisition and retention, ultimately contributing to a more effective and customer-centric approach to business operations.

What Does the Term ‘Customer Lifetime Value’ Mean?

Assessing your expenses extends beyond merely glancing at your Customer Acquisition Cost (CAC). Recognizing that customer value varies significantly, some customers bring greater returns than others. This is where considering Customer Lifetime Value (CLV) becomes crucial.

CLV encompasses the entirety of a customer’s financial contributions to your business during their association with your company.

CAC alone cannot unveil the full financial picture, as it overlooks the varying degrees of value individual customers bring over their lifetime.

To make sound financial decisions, understanding and factoring in CLV is imperative.

Customer Lifetime Value Calculation Made Simple

When customers subscribe to a $30-per-month service and cancel after three months, their CLV is $90, a vital metric for SaaS businesses. Calculating the average CLV by summing all subscribers’ CLVs and dividing by the total number of customers helps determine the LTV to CAC ratio.

For instance, if you have three customers with CLVs of $100, $150, and $500, the average CLV is $250. This insight informs marketing, retention, and resource allocation decisions for growth and profitability.

Lowering CAC is crucial; it’s determined by dividing total sales and marketing costs by the number of new customers acquired.

Understanding CAC, CLV, and the Customer Churn Rate is vital. Calculate CAC using the formula: total acquisition costs divided by new customers acquired. These metrics are essential for a successful SaaS business, impacting its financial health and long-term success.

Average Customer Acquisition Costs in Different Industries

Let’s proceed to review the industry-specific average costs associated with customer acquisition.

SaaS Customer Acquisition Cost Averages

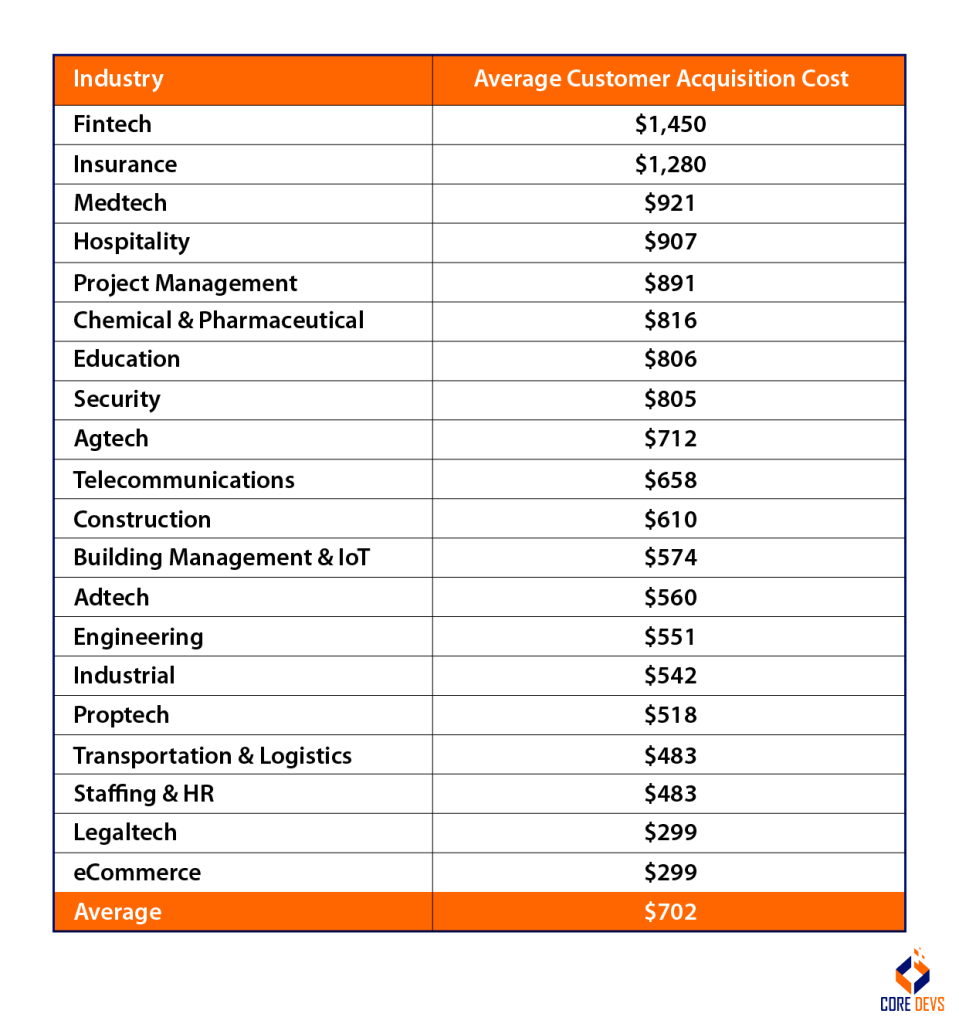

The SaaS industry has a substantial range in average customer acquisition costs across various sectors.

First Page Sage‘s findings reveal the following:

- In the SaaS industry as a whole, companies typically bear an average customer acquisition cost of $702.

- Notably, the fintech sector leads the pack with the highest customer acquisition cost, averaging $1,450 per new customer.

- Conversely, the eCommerce industry enjoys having the most economical customer acquisition cost within the SaaS industry, with an average expenditure of just $274 to secure a new customer.

Here is a comprehensive list of customer acquisition costs across various sectors within the SaaS industry:

Average Cost of Securing B2B Customer Acquisition

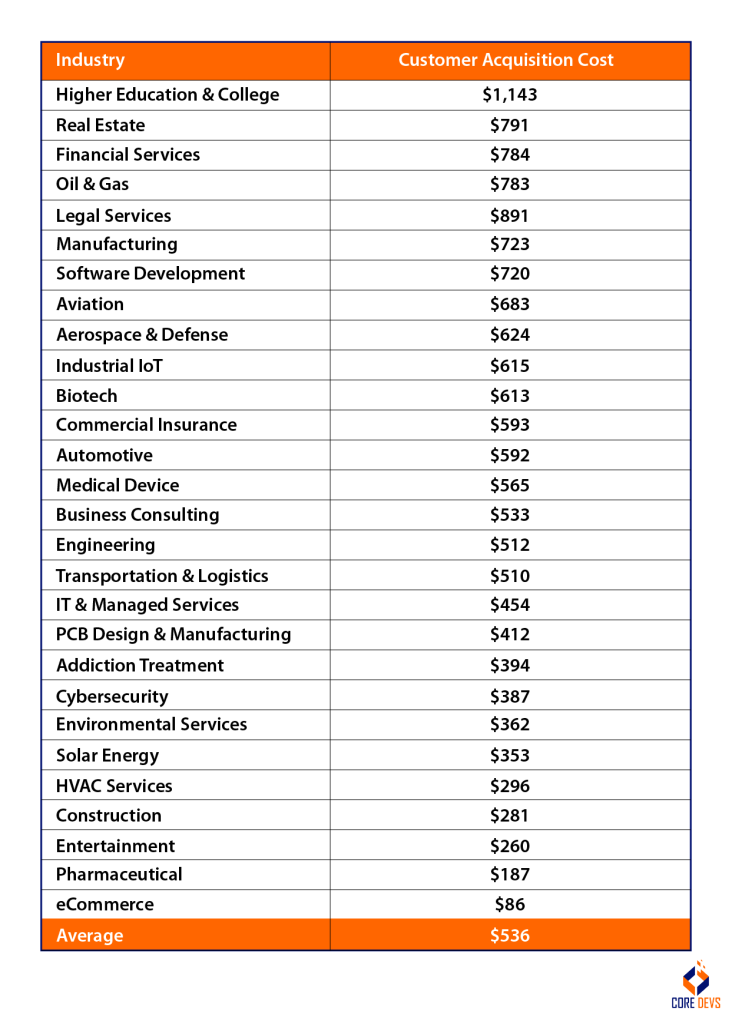

The cost of acquiring customers in the B2B sector typically involves a combination of both organic and paid acquisition expenditures.

As per the data provided by First Page Sage:

- In B2B companies, the average expense for customer acquisition amounts to $536.

- Among B2B companies, the highest customer acquisition cost is found in the higher education and college sectors, averaging $1,143 per new customer.

- In contrast, eCommerce B2B businesses have the lowest customer acquisition cost, with an average of $274 required to acquire a new customer.

These figures represent the average customer acquisition costs prevalent among various B2B companies:

Average Customer Acquisition Investment in E-commerce

Customer acquisition costs differ among e-commerce businesses due to the unique characteristics of their respective industries.

As reported by First Page Sage:

- In e-commerce, the average customer acquisition cost is $70.

- The jewelry e-commerce sector, in particular, faces the highest customer acquisition cost, averaging $1,143 per acquisition.

- On the opposite end of the spectrum, the food and beverage industry boasts the lowest customer acquisition cost, with an average of $53 required to acquire a new customer.

Here is a detailed breakdown of customer acquisition costs across various e-commerce businesses:

Improving Customer Acquisition Cost Efficiency

Let’s examine strategies for enhancing your customer acquisition efforts.

Analyzing and Enhancing Marketing Channel Performance

Analyzing and enhancing the effectiveness of marketing channels plays a pivotal role in reducing your customer acquisition expenses. By discerning which marketing channels yield optimal outcomes, you can strategically allocate your resources, thus maximizing your return on investment.

Employing analytical tools enables you to monitor crucial metrics such as conversion rates, click-through rates, cost per click (CPC), and cost per acquisition (CPA) across each marketing channel.

These metrics offer valuable insights into the efficiency of each channel for acquiring new customers.

Subsequently, you ought to scrutinize these metrics to pinpoint your high-performing channels. Tailor your marketing strategy by directing additional resources toward optimizing the performance of these successful channels.

Increase Conversion Rates through Conversion Funnel Optimization

Improving your conversion funnel is vital to boosting conversion rates, attracting better-qualified leads, and managing customer acquisition costs effectively (CAC). To start, outline the key stages in your conversion funnel, from the initial interaction to the final conversion.

Next, dive into a detailed analysis of your conversion funnels. This step helps you identify areas that need improvement, such as user friction or conversion leaks that slow down potential customers’ progress.

Afterward, take proactive steps to address and eliminate these issues. You’ll create a smoother, more efficient conversion process by making strategic changes and optimizations.

This, in turn, leads to improved conversion rates, reduced CAC, and a stronger lead generation system.

Maximizing Customer Lifetime Value with Product-Led Growth Strategies

A product-led growth strategy is about letting users freely explore and experience a product before deciding to buy it. This approach reduces the need for expensive sales and marketing efforts because potential customers get to see the product’s value for themselves.

The key to succeeding with this strategy is engaging users effectively within the product. Using in-app tactics to guide users toward paid plans would be best.

This lowers your costs for acquiring new customers and keeps users around longer, increasing the overall value they bring to your business.

For instance, you can set usage limits for certain features and then send upgrade messages when users approach those limits. This helps users understand the product’s full potential and encourages them to upgrade.

Loom, for example, sends upgrade messages when users get close to feature usage limits and nudging them to take action.

Customer Segmentation for Precision Targeted Marketing

Customer segmentation offers a potent approach for tailoring marketing efforts to effectively cater to diverse customer needs. By leveraging this strategy, you can craft individualized experiences and offerings, making engaging and converting potential customers easier.

To implement customer segmentation successfully, harness data-driven insights regarding your potential customer base. Once you have pinpointed your ideal customer profiles, focus on targeting and categorizing those more likely to convert.

In SaaS companies, customer segmentation based on in-app activities proves highly efficient. It empowers these companies to gain deeper insights into their customers’ behavior and design marketing campaigns that align with specific segment preferences.

Consequently, businesses can trigger in-app marketing messages that prompt potential customers to take tailored actions leading to conversion. This approach ultimately drives down the overall customer acquisition cost as more customers are successfully acquired.

Creating Personalized Onboarding Experiences

Tailoring the onboarding journey to align with the preferences and needs of potential customers can leave a lasting impact and boost the odds of them becoming paying customers.

Customers who receive a personalized onboarding experience tend to discover more value and actively engage with the product or service. Consequently, they are more likely to remain loyal to your offering and less likely to churn, leading to improved user retention and a higher conversion rate.

This approach also helps reduce customer acquisition costs (CAC) since there’s no need for costly additional acquisition efforts.

Within the SaaS industry, it’s a standard practice to utilize welcome surveys for gathering customized profile data. This data, in turn, facilitates the delivery of tailored onboarding experiences that cater to individual preferences, objectives, and pain points.

Implement Referral Initiatives to Attract New Customers

Encouraging your current customers to refer new users can be a potent strategy for harnessing your existing customer base as a valuable source of potential leads.

When satisfied customers recommend your product or service to others, it carries a higher trust and credibility, significantly enhancing your conversion rates.

Referral programs empower contented customers to endorse your product or service through word-of-mouth marketing. Customers who have had positive experiences and receive incentives to refer others can evolve into natural brand advocates.

This authentic form of advocacy trims your customer acquisition costs by reducing reliance on costly marketing efforts and cultivates a robust sense of loyalty among your customer base.

Consequently, you acquire new customers at a reduced cost while elevating the prospects of retaining them for the long haul.

Conclusion

Understanding and effectively managing the Average Customer Acquisition Cost (CAC) for a Software as a Service (SaaS) company is paramount to its success.

CAC isn’t just a financial metric but a reflection of your overall business strategy. It encompasses marketing efforts, sales tactics, customer retention, and scalability.

By meticulously tracking and analyzing your CAC, you can make informed decisions, allocate resources wisely, and steer your SaaS company toward sustainable growth.

A well-managed CAC is a strategic investment that can elevate your SaaS company, driving customer acquisition, revenue growth, and long-term success. So, roll up your sleeves, dive into the data, and optimize your CAC today. Your SaaS business’s future success depends on it!

If you want to learn more about Average Cac for SAAS, stay connected to Core Devs.